India Entry Services

BUSINESS STARTUP CONSULTING SERVICES IN INDIA

India has been the preferred destination for overseas investors and continues to attract foreign investment across sectors for a variety of reasons. Numerous economic and administrative measures, cheap labor costs, and simplified foreign investment procedures have certainly paved the way for foreign multinationals to take an informed decision for their business growth. A business requires a proper India Entry Service Strategy and knows proper channels of India entry before it can invest in India.

Any investment by a non-resident individual or business is subject to the eligibility conditions and restrictions in the applicable foreign direct investment policy. While general permissions have been accorded to many sectors subject to the participation norms under the Automatic Route, investment after going through the government approval is also allowed, subject to certain restrictions, in other cases.

There are several routes foreign multinationals can choose to invest in India. Foreign multinationals can start their office in India and enter the Indian market to sell their goods or services through any of the following ways:

- Liaison office;

- Branch office;

- Branch office in Special Economic Zone;

- Project office;

- Wholly owned subsidiary and a joint venture in India;

- Limited Liability Partnership;

Our team of professionals has rich experience in setting up a business in India for foreign investors and multinational groups. Our range of service offerings includes an initial market study to post-setup support for operational optimization. We invest considerable time in understanding the business operations, needs, and goals of any business enterprise, and based on this offer our structured solutions.

EASE OF DOING BUSINESS IN INDIA

The rank of India raised to 77 in 2018 from 100 in 2017 among 190 countries that participated in World Bank Ranking. Ease of Doing Business improved from 124.82 in 2008 until 2018, to 139 in 2010, and holding a record of high to 77 in 2018.

In recent years, the Indian startup environment has really taken off and emanated into attention on its own—motivated by factors like massive funding, evolving technology, consolidation activities, and a burgeoning domestic market. The statistics are depicting—from roughly 3000 startups in 2014 to a forecast of more than approx. 11000 by 2020, this is certainly not a passing trend. It has brought a revolution in the business and motivated young talent to start their own company by receiving great motivation from a successful startup entrepreneur. India is changing at the fastest rate and opening a gate for a global entrepreneur to establish a business in India and grow at a faster pace. We at ASC help businesses with end-to-end advisory and consulting to prepare their business for entry into India.

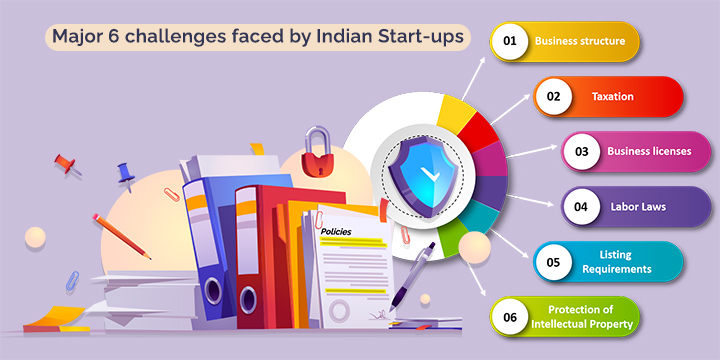

LEGAL CHALLENGES FACED BY A STARTUP IN INDIA

Legal Challenges are one of the biggest challenges encountered by startup companies. The startup companies might lend up into trouble when the company fails to meet all the legal requirements.

For a startup, it is not possible to pool in resources equal to the deep-rooted corporate house. However, with proper knowledge and support from the right consultancy, the risk can be prevented or diminished.

- Business structure: First and foremost thing about business is to classify the top requirement of the business. Based on the set of requirements, the structure of the business is articulated such as sole partnership, proprietorship, a public company, private limited company, or a limited liability partnership. There are certain legal requirements that need to be followed for each business structure.

- Taxation: Full acquiescence with tax laws is compulsory to avoid punishment and penalties. Startups must have inclusive knowledge about their tax liabilities towards the state and central governments. Startups should ensure that they are aware of the new taxes, their impact on the business model, and their liabilities.

- Business licenses: To ensure your business run without any trouble, the required licenses have to be attained. Most licenses are based on industry-specific. For instance, a startup food business has to obtain licenses relating to food safety, health, and food adulteration. The conditions mentioned in the license have to be fulfilled to avoid further complications.

- Labor Laws: When a startup inaugurates operations and employs employees, it is subject to the countries labor laws. The major challenge for startups is to safeguard that it is compliant with all the appropriate labor laws. These laws relate to minimum wages, provident funds, payment of gratuity, maternity benefits, and prevention of sexual harassment at the office, etc.

- Listing Requirements: A company has to comply with relevant SEBI regulations to list its securities in a stock exchange. These are regularly updated, and hence it is important for a startup to be well-versed in all the up-to-the-minute developments.

- Protection of Intellectual Property: With the growth in startup entrepreneurs, the company needs to create intellectual property (IP) simultaneously comprised of codes, research findings, algorithms, designs, etc. This is done to protect the IP from misusing by other entities or competitors and gain profit. Basic tenets of intellectual property rights should be considered such as copyright protection, trademark registration, patent filing, etc.

Also, Register your Company in Canada, US, European Union, Singapore, Japan with the help of ASC.

How ASC Helps?

- Understanding the business plan or goal of foreign investors;

- Identifying any restrictions in the Foreign Direct Investment policy including obtaining any approval;

- Assisting in identifying the right or suitable geographical locations for establishing business operations;

- Identifying the appropriate jurisdiction for entry into India from tax and regulatory perspectives;

- Identifying the suitable corporate structure viz company, LLP, etc. for carrying on business operations in India;

- Devising tax-efficient cash or profits repatriation strategies;

- Transaction advisory in case an already existing business is acquired e.g. share deal or asset deal;

- Drafting / reviewing contracts with local joint venture partners, due diligence support, other business contracts;

- Setting up formalities like the incorporation of company or LLP, the opening of bank accounts, obtaining tax deduction account number (TAN) and permanent account number (PAN);

- Providing administrative, legal, HR, Accounting, and IT support;

- Ongoing tax and regulatory compliances.

FREQUENTLY ASKED QUESTIONS

The compliance and regulations in India to start a business in India totally depends on the legal and business structure of the company. Foreign company is obligated to get approval from the MCA (Ministry of Corporate Affairs), RBI (Reserve Bank of India), and other relevant government bodies to smooth company formation in India.

India is a huge market with immense opportunity; however, it involves end number of risks and challenges that needs to be taken care. Some of the challenges business startups face are complex regulatory environment, lack of access to capital and resources, bureaucratic hurdles, cultural and language barriers, and stiff competition. To mitigate these challenges into opportunity, it is important to seek professional consultancy to stay updated with the latest market trends and government policies to accordingly plan business strategies.

India allows foreign investment in almost all the sectors, however, certain limitations on sectors like defence, telecom, and media sectors are being defined.

Foreign entities are subject to Indian tax laws & regulations to start a business in India. They need to register for GST (goods and services tax), get business PAN (permanent account number) and other applicable documentation. Foreign entities are also need to comply with transfer pricing regulations and withholding tax on certain transactions.

Foreign company planning to start business in India need to comply with labor laws and regulations such as the Employees' Provident Funds and Miscellaneous Provisions Act, Minimum Wages Act, and the Industrial Disputes Act. They need to comply the applicable labor laws and regulations in their company related to wages, safety and health, working hours, and employee benefits. They also need to consider the local employment laws and regulations compliance related to hiring and termination of employees’ policies.